In recent news reported by Offshore Alert, a prominent regional offshore banking publication, and later corroborated by the Trumpet, Jolly Harbor Resident and Antiguan/Canadian Citizen Jack Stroll has initiated a lawsuit against the Attorney General of Antigua and Barbuda. Stroll accuses the government of failing to fulfill its promise to redeem a US$10 million Treasury Bill.

Stroll and his Nevis-based company, Neverland Services S.A., filed the lawsuit against the Attorney General, who stands as the official representative of the Antiguan and Barbudan Government, at the Eastern Caribbean High Court this past Tuesday.

The crux of Stroll’s suit demands that the court enforce a mandate that the government meet its pledge to redeem the Treasury Bill, both verbally, publicly and in cabinet minutes. If the government fails to do so, Stroll is seeking an alternative award of US$10 million in damages due to breach of contract.

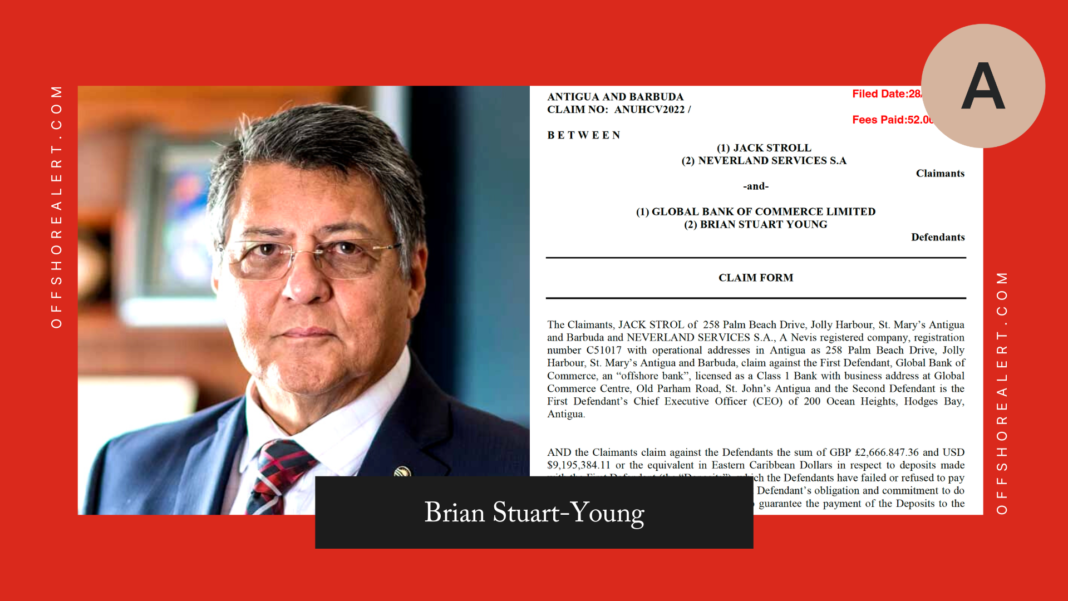

This lawsuit is the most recent development in Stroll’s relentless two-and-a-half-year endeavor to recover deposits amounting to US$9.2 million and £2.7 million from the Global Bank of Commerce and Brian Stewart-Young Personally, Antigua’s most established offshore bank.

In 2022, Stroll and Neverland Services had filed a suit against the bank and its CEO, Brian Stuart-Young, following the bank’s disregard for their redemption requests initiated at the end of 2020. The defendants settled this case within the year, with a court order mandating the bank to pay US$7.4 million and £2.75 million by January 6, 2023.

Despite several assurances and agreed-upon payment schedules, Stroll has since been unsuccessful in collecting from either the Global Bank of Commerce or Stuart-Young.

The subject of Stroll’s current redemption effort, the Treasury Bill, was issued by the Government to the bank in 2018 and offered as collateral for the debt Stroll was owed in 2021.

Despite the government’s persistent disregard for its obligations and cabinet decisions, a formal cabinet declaration signed by Prime Minister Gaston Browne on January 12, 2023, assured, “the Government of Antigua and Barbuda hereby provides this Firm Letter of Undertaking that it shall redeem in full the aggregate face value of the T-Bills in the amount of USD$10,000,000.00 on or before April 30th, 2023″. This matter is the focus of the ongoing litigation.

The declaration further stipulated, “…and in relation to which it shall hypothecate an equivalent amount of the credit balances in the deposit accounts held in the name of the GOAB for the sole purpose of this early redemption of the said T-Bills.” This action was not taken, leading to inquiries regarding why the Antiguan Government held funds in the Global Bank of Commerce.

When the redemption deadline passed without action, Stroll took legal action against the Attorney General.

Yesterday’s complaint stated, “The very purpose of the Firm Letter of Undertaking was to guarantee the redemption of the T-Bill to enable GBC to satisfy its financial obligations owing to the Claimants and also to alleviate political and financial pressure on the Prime Minister.” The government had hoped that this would deter Stroll from initiating further legal action against the Global Bank of Commerce.

The claim implies that Prime Minister Gaston Browne continues to make pledges to foreign investors that he seemingly has no intention to fulfill, using Antigua and Barbuda’s resources for personal financial and political advantage. Questions are mounting as to why the government would assume a private debt by a privately owned offshore bank, instead of carrying out their enforcement responsibilities under financial and regulatory statutes.

Offshore Alert continues to disclose its findings, revealing that the insolvent Global Bank of Commerce has been allowed to maintain operations by the Antigua and Barbuda’s banking authority, the Financial Services Regulatory Commission (FSRC).

Despite the FSRC’s apparent non-intervention, potential liabilities for the nation of Antigua and Barbuda continue to grow. The very regulatory body established to prevent such liquidity issues across the banking sector seems to be disregarded. The FSRC’s inaction raises serious concerns about its effectiveness and the repercussions this could have for the financial health of the country.

Consequently, this situation has cast a spotlight on the role of the FSRC and the government in managing the health and integrity of the offshore banking sector in Antigua and Barbuda. As inquiries continue to build, it is becoming increasingly apparent that both the government and the FSRC must take decisive action to resolve these issues and restore confidence in the nation’s banking sector and their ability to regulate entities as they are required to under the law.

Questions remain as to how an obviously insolvent bank can remain open for business in Antigua and Barbuda, and why the Financial Services Regulatory Commission has not taken steps, as required to do under Antigua statute, to protect depositors.